Credit cards interest: how is it calculated?

When we use credit cards, one of the most usual questions is how the interest is calculated on the credit the banks offer to the cardholder. In this article we will try explain this topic in a simple way, we will ilustrate some of the most encountered examples in practice and we will guide you with a few recommendations and suggest you several questions you may want to ask your bank when you are looking for a credit card.

How does the interest on credit cards work and how is it calculated?

First, let's assume some facts for the sake of an example:

- You use the credit card to buy good or services in the amount of 1.000€.This means you use the credit of the card for this given amount.

- According to your arrangement with the bank, you have to pay the credit in 30 days

- The grace period the bank offers you is 30 days. This means that you have 30 more days to pay the credit after the initial 30 days. Note that the grace period is subject to the arrangement with the bank.

- The interest of your card is 12% per year.

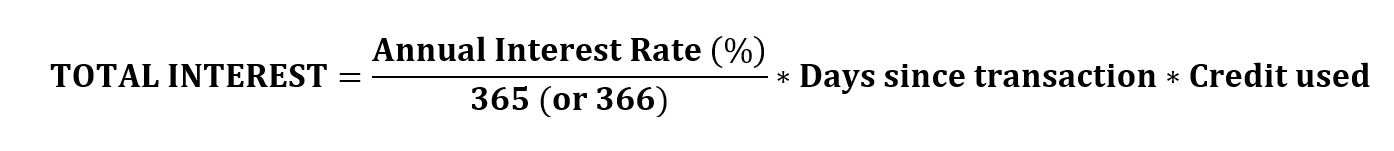

To calculate the total interest to be paid on the credit card, one needs to take into consideration the credit used (or the outstanding balance of the credit used, in some situations), the elapsed time since the transaction, and the annual interest rate of the credit card. It may be that in some particular situations, the total interest will also depend on variables such as the type of the credit card you have, or the different credit lines you have on your card, but for the sake of simplicity, we will not consider the last two inputs. In general, the total interest is calculated, according to the following formula:

If you decide to pay the credit, you may be in one of the situations presented below:

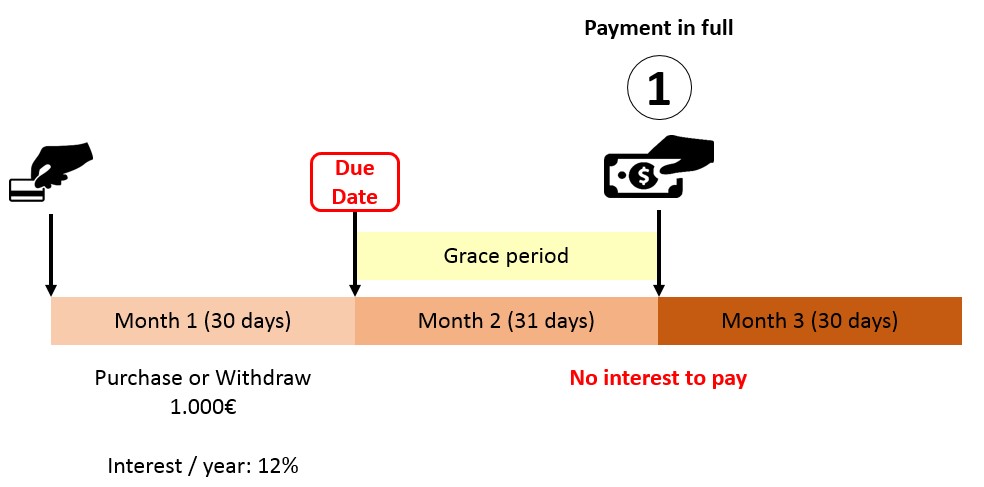

1. You decide to pay the credit back in full within the grace period

Usually, in this situation the banks wave the interest charges if the outstanding balance is paid back in full. They do this because they consider that you fulfilled the arrangement, both in terms of repayment (i.e. you paid back the credit in full) and of deadline (i.e. you paid back the credit within the grace period). It goes without saying that you will not be charged any interest in case you would have paid back the credit before the due date. If such a situation occurs, the thing you need to pay attention to is to make the payment within the grace period.

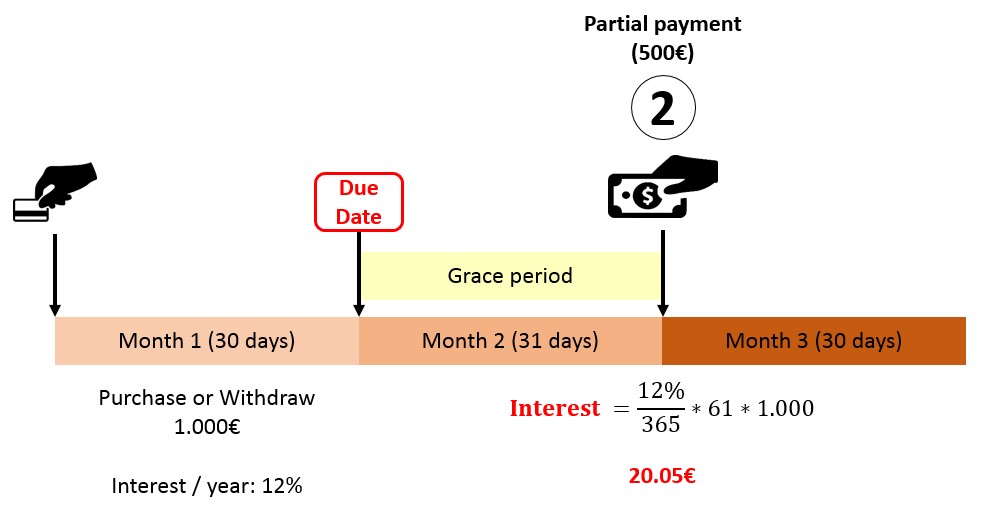

2. You decide to make a partial payment within the grace period

First, note that it does not matter whether you pay the credit at the beginning of the grace period or towards the end. Despite the fact that you paid the credit within the grace period, usually the banks will charge you the full credit you used. They will do this because one of the terms of the arrangement (i.e. the credit was not paid back in full) was not respected. The interest will be calculated it based on the number of days elapsed from the transaction and on the on the full amount of the credit. The "penalty" in this particular case comes from the fact that the credit was not paid in full, be it within the grace period.

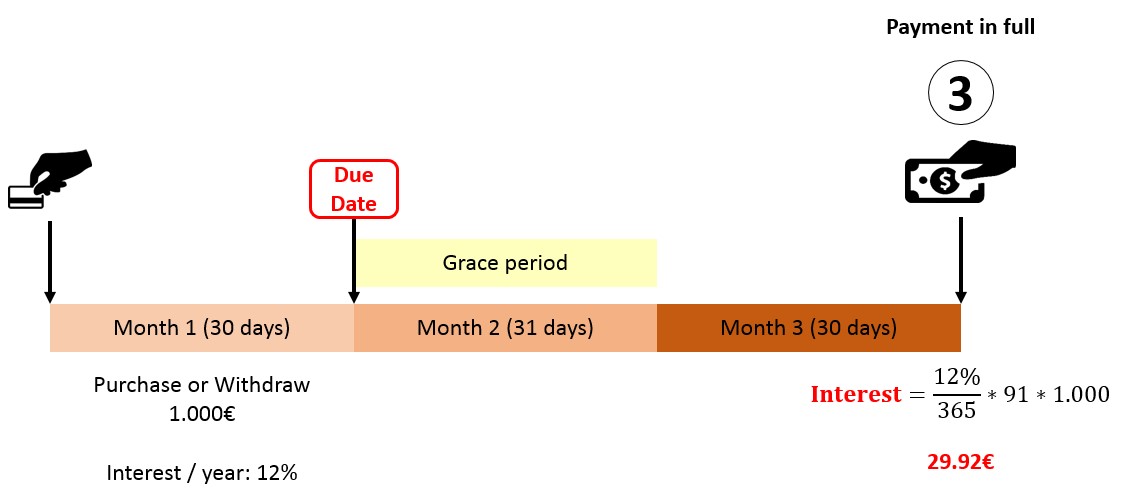

3. You decide to pay in full the credit after the end of the grace period

Compared to the case described in the previous situation, in this situation, despite the fact that you paid the credit back in full, one of the terms of arrangement was not respected (i.e. you paid the credit back after the expiration of the grace period). In this case, you will pay the interest on the whole credit and the interest will be calculated based on the number of days elapsed since the transaction. The faster you will pay the credit, the less interest you will need to pay.

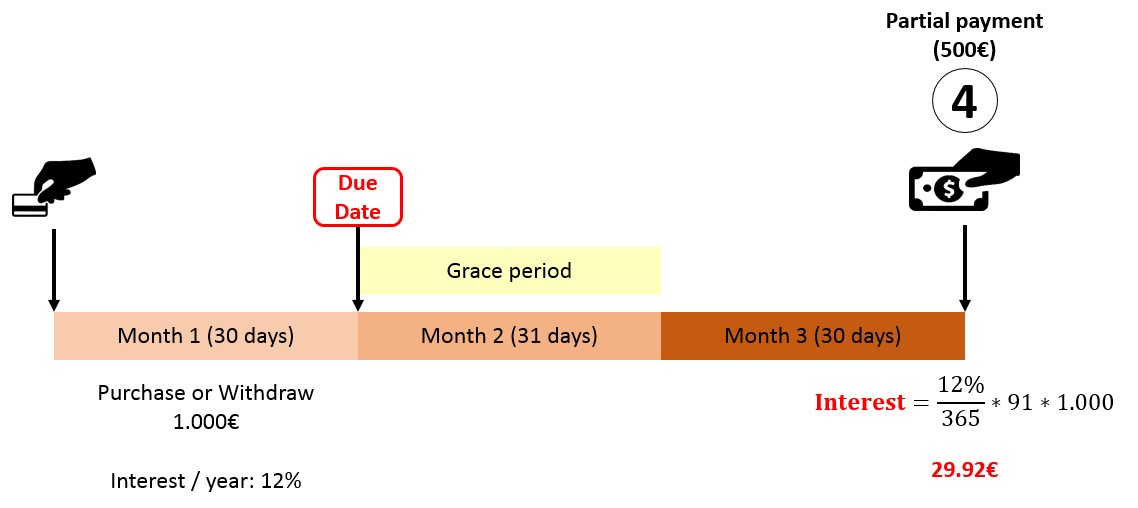

4. You decide to make a partial payment after the end of the grace period

In this situation, both terms of the arrangement were not respected. You paid the credit back after the grace period and you made only a partial payment. Banks will charge you the interest on the whole credit (1.000€) and not on the outstanding balance of the credit (500€). The interest will be calculated based on the number of days elapsed since the transaction. Every additional month after that you will still have to pay interest on the whole amount until the credit is paid in full. The faster you will pay the credit, the less interest you will need to pay.

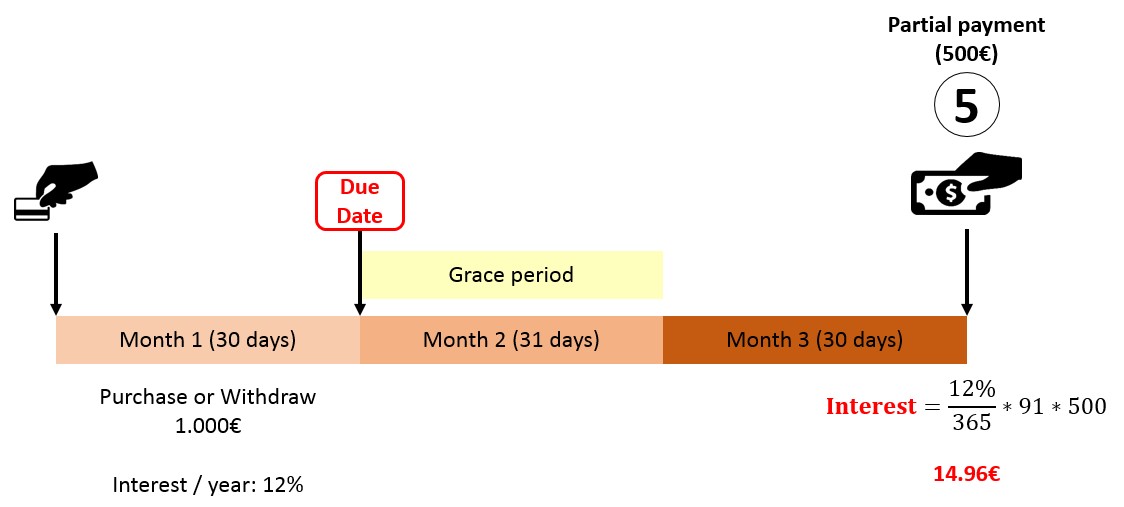

5. You decide to make a partial payment after the end of the grace period (the bank may use the outstanding balance to calculate the interest)

This situation is somehow similar with that described under point 4. The difference is that, based on the negotiated arrangement you have with the bank, the later will use the outstanding balance to calculate the interest and not the total credit despite you have not respected the arrangement, neither in terms of the deadline nor the amount paid. Note that such a situation is not a general one and it depends on the commercial relationship the cardholder negotiated with the bank.

What to look for in the credit card interest information?

Sometimes the banks may propose you multiple credits segments on your credit card (i.e. one segment for the acquisition of home appliances, one segment for personal use, one segment for travels, etc.). They estimate that the different types of credits support different risks and hence, may need to have different interests. Yet, all credits are bundled under the same credit card. However, the way the total interest is calculated depends on the methodology chosen by the bank, which although transparent, may be not easy to understand. For instance, if part of the credit corresponding to the highest interest is paid back, the bank may decide to apply to the outstanding balance, still the same highest interest.

Often, the banks may invite the cardholders to make minimum payments for the credit used, before the entire outstanding balance being paid. Banks use such initiative, on one hand to more rapidly collect the borrowed funds from the cardholders and invest them back in other operations and, on the other hand, to limit the exposure of cardholders. Although such initiatives aim to diminish the amount of credit on which the interest is calculated, the calculation of the interest on the outstanding balance may be a complicated enterprise for the cardholder. The banks are more and more obliged to work transparently and provide information to the cardholders when they ask for funds to be paid back in advance.

What do I need to ask the bank in order to avoid unpleasant surprises?

Do I have a grace period to repay the credit? How long is it?

Possible Actions

- Negotiate a longer grace period, while keeping the annual interest unchanged

- Negotiate the bank to calculate the interest from the elapse of the grace period and not from the transaction date

Is the interest calculated on the total credit or on the outstanding balance?

Possible Action

- Negotiate with the bank to pay the interest on the outstanding balance, while keeping the annual interest unchanged (Option 5)

Do you (bank) use different balance segments for the credit? How the interest is calculated?

Possible Action

- Avoid credits with different segments and potentially with different interest! The calculation of the interest will be a complicated story and the banks will tend to calculate the interest based on the highest interest rate.

Conclusion

Pay your balance regularly and , preferably, before the end of the grace period in order to avoid accumulating unnecessary interest!!!