N26 You

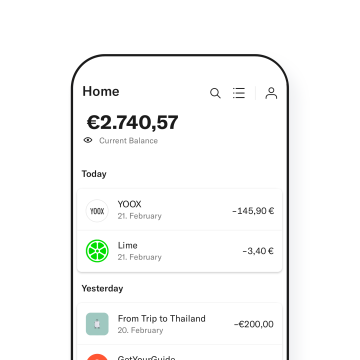

A debit card for everyday and travel

A premium account for your daily needs and travel abroad for just €9.90 per month—without the hidden fees. Open your bank account, and get an N26 debit card in your choice of color.

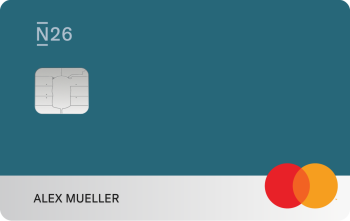

A Mastercard debit card to suit your lifestyle

Choose from 5 vibrant colors—Ocean, Sand, Rhubarb, Aqua and Slate—for your contactless Mastercard.

Save up for what matters with Spaces

With N26 Spaces, create up to 10 sub-accounts to budget better and put funds aside for your personal projects. Create rules to move money over without second thought, and invite up to 10 other N26 users to save up together for common goals—such as a joint birthday present with family, or a new sofa for the living room with your roommates.

Discover Spaces

Medical emergency cover

N26 You covers you in case of medical emergencies abroad. It also includes insurance for your partner and children, with access to 24/7 medical phone assistance.

Trip curtailment or cancellation

If you can’t make it to the airport, or must shorten your stay due to unforeseen circumstances, we have you covered.

Flight delay insurance

We all know that time is money. With N26, don’t get caught out—receive compensation in case of flight delays of more than 4 hours.

Insurance for delay and theft of luggage

Don’t get stuck without your essentials. Claim compensation if your luggage is delayed or lost, or if your flight is more than 4 hours late.

Emergencies when travelling

Travel medical insurance up to €1,000,000 for you, your partner and kids in case of emergencies, including dental and winter sports***.

Personal liability while traveling

Coverage up to €500,000 for Travel Liability in case you’re legally liable for damage to a third party or their property during a trip.

Explore N26 Perks, whatever your interest

N26 You is so much more than a bank account, giving you access to a wide range of deals and offers from leading brands such as Audible, TIDAL, Headspace and many more. We’re constantly evolving these N26 Perks to fit in with you—and you can check what’s currently available to you in your app.

View partner offers

Customer Support is here to help

Do you need assistance? Whatever you need, our Customer Service team is at your disposal. Reach them directly via the chat function in your N26 mobile app, or through the N26 WebApp on your desktop. You can also find answers to your questions via the Support Center.

Visit our Support Center

Jump into the future with N26 Metal

Discover a premium banking experience, with an elegant metal card, an extensive insurance package, special partner offers, and so much more.

Upgrade to N26 MetalNeed an extra card? No problem.

Losing your card and waiting for a new one to arrive is annoying—that’s why keeping a spare makes a lot of sense. Order a second Mastercard to use with your account right in the N26 app, and make sure you always have access to your cash.

Read moreFrequently asked questions

What are the benefits of an N26 You account?

N26 You is a premium membership bank account that comes with a colorful debit card, travel insurance and cover for flight, luggage and curtailment delays as well as luggage loss. You’ll also get exclusive partner deals and free foreign currency ATM withdrawals worldwide. See T&C’s for full details and availability.

How do I open an N26 You bank account?

To open an N26 You account, you must meet our eligibility criteria. If you do, simply register on our website, or by downloading the N26 app onto a compatible smartphone. Opening an account takes only a few minutes and is done without paperwork. Once you’ve verified your identity, your bank account will be ready to use.

For more information on opening an N26 You bank account, as well as the documents that you need, visit our Support Center.

Is the N26 Mastercard a debit card, a credit card or a prepaid card?

The N26 You is a Mastercard debit card, meaning that all charges are debited in real-time from your account. This is why it’s important to always have enough funds in your balance.

How to get my debit card?

After ID verification, you can choose the color you want for your N26 You card—we’ll then order it for you, and it will be delivered to the address you’ve provided. You can also specify whether you’d like standard or express delivery.

How much does the N26 You bank account cost?

An N26 You bank account costs €9.90 per month.

What kind of travel insurance does the N26 You bank account offer?

N26 You comes with an extensive insurance package, provided by Allianz Assistance. This includes coverage for travel and baggage delays, baggage loss, medical coverage in case of emergencies abroad, and much more.

Do you charge foreign transaction fees?

We don’t charge an exchange rate fee if you pay with your Mastercard or withdraw cash in foreign currency.

What are the advantages of Mastercard Travel Rewards?

The Mastercard Travel Rewards program gives you access to hundreds of cashback offers from top brands while traveling abroad. With cashback offers across arts and culture, shopping, hotels, culinary experiences, entertainment, and more, you can treat yourself year-round and save on your holidays abroad. To take advantage of Mastercard Travel Rewards, all you have to do is pay at participating stores with your N26 Mastercard.

*The interest rates are based on your N26 membership: 2.8% for Standard, Smart, and You, and 4% for Metal. The interest rates are variable and subject to change in the future. Interest rates p.a. are equivalent to AER in Ireland and TANB in Portugal (before taxes).

**The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

***Legal Notice: You can see all the information you need to start a claim or call Allianz Global Assistance Europe in case of an emergency in the N26 app. N26 You features comprehensive insurance coverage from Allianz Global Assistance Europe (trade name of AWP P & C.S.A - Dutch branch) one of Europe's most trusted insurance companies.

***Legal Notice: You can see all the information you need to start a claim or call Allianz Global Assistance Europe in case of an emergency in the N26 app. N26 You features comprehensive insurance coverage from Allianz Global Assistance Europe (trade name of AWP P & C.S.A - Dutch branch) one of Europe's most trusted insurance companies.

Mastercard offers a range of complimentary privileges as part of your N26 You World card status. Every N26 You card holder is automatically entitled to enjoy these benefits, tailored to the needs of frequent travelers and globe-trotters.

If you are planning your next trip, also make sure to check out the Mastercard Priceless Cities* for exclusive events and recommendations. You only need your Mastercard to discover the most beautiful cities in the world, and your new experiences can begin.